Solo 401k Basics: The Complete Guide for Self-Employed Professionals

As a self-employed professional, you're used to wearing many hats. But there's one role you can't afford to neglect: retirement planner. Without an employer-sponsored plan, the responsibility for securing your financial future falls entirely on your shoulders.

That's where the Solo 401k comes in — potentially the most powerful retirement solution available to self-employed individuals today.

In this guide, you'll discover why a Solo 401k might be your ticket to a secure retirement, who qualifies, how much you can contribute, and exactly how to get started. By the end, you'll have a clear path forward for transforming your self-employment income into lasting retirement wealth.

Prefer to Watch?

Get a visual explanation of Solo 401k basics in our comprehensive video guide.

What Makes Solo 401ks Different (and Better)

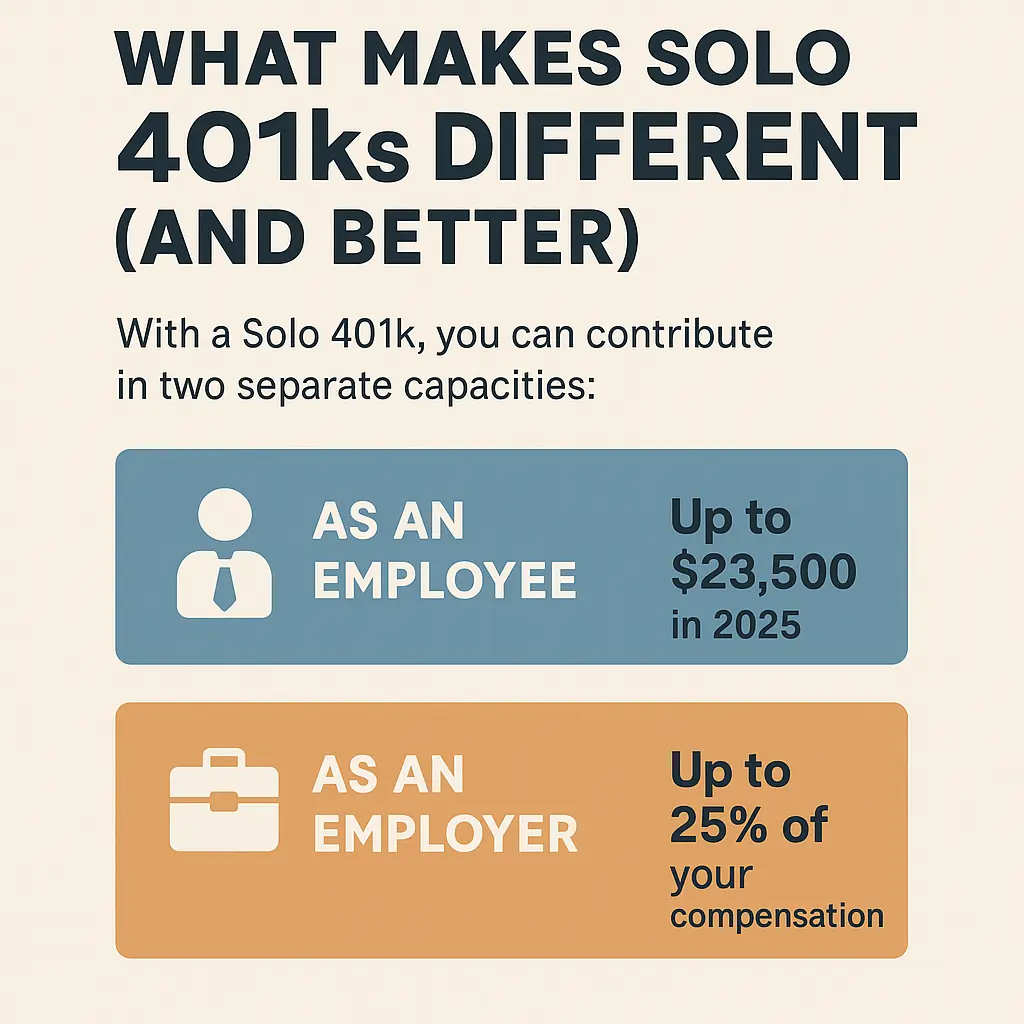

A Solo 401k (also called an Individual 401k or Self-Employed 401k) operates on a simple but powerful premise: as a business owner, you wear two hats — employer and employee. This dual role creates a unique advantage that other retirement plans simply can't match.

The Dual Contribution Advantage

With a Solo 401k, you can contribute in two separate capacities:

- As an employee: Up to $23,500 in 2025 (plus an additional $7,500 if you're 50+)

- As an employer: Up to 25% of your compensation

This two-pronged approach allows for significantly higher contributions than SEP IRAs or SIMPLE IRAs, especially at lower income levels.

Key Advantages Over Other Retirement Plans

| Feature | Solo 401k | SEP IRA | Traditional IRA |

|---|---|---|---|

| 2025 Max Contribution | Up to $77,500 | 25% of income (max $69,000) | $7,000 |

| Catch-up (50+) | $7,500 | $0 | $1,000 |

| Roth Option | Yes | No | Yes (with income limits) |

| Loan Provisions | Yes (if plan allows) | No | No |

Beyond these numerical advantages, Solo 401ks offer unparalleled flexibility. You decide exactly where and how your money is invested — no limited menu of mediocre mutual funds. Whether you prefer stocks, bonds, ETFs, or even alternative investments (with a self-directed plan), you maintain control.

Do You Qualify? It's Simpler Than You Think

The eligibility requirements for a Solo 401k are refreshingly straightforward. You qualify if:

- You have self-employment income (any amount!) from a business with no full-time employees other than yourself and potentially your spouse

- You have legitimate self-employment activity with the intention of making a profit

That's it. No minimum income threshold. No complicated business structure requirements.

Common Scenarios Where You Qualify:

Don't Disqualify Yourself by Mistake

Many self-employed professionals incorrectly assume they don't qualify. Let's clear up some common misconceptions:

"I have a full-time job with a 401k already."

You can still open a Solo 401k for your side business! Your employer's 401k and your Solo 401k are separate plans.

"I only made $5,000 from my side hustle."

There's no minimum income requirement. Even modest self-employment earnings qualify.

"I have part-time workers helping me."

As long as your employees work less than 1,000 hours per year (about 20 hours per week), you can still use a Solo 401k.

Contribution Power: How Much Can You Actually Save?

This is where Solo 401ks truly shine. For 2025, you can contribute:

As an Employee (Elective Deferrals)

- Under age 50: Up to $23,500

- Age 50 or older: Up to $31,000 ($23,500 + $7,500 catch-up)

The best part? You can contribute this amount regardless of your income level — even if your business only made $30,000.

Plus as an Employer (Profit-Sharing Contribution)

- Up to 25% of your compensation (calculated as your net earnings from self-employment minus half of your self-employment tax and your employee contribution)

Real-World Example

Let's say you're 45 years old earning $100,000 from your consulting business:

- Employee contribution: $23,500

- Employer contribution: $18,587 (calculation adjusted for SE tax)

- Total contribution: $42,087 (42% of your income!)

Compare this to a SEP IRA, where your maximum contribution would be about $18,587 — less than half what you can put into a Solo 401k.

Tax Advantages That Build Wealth

Your Solo 401k offers three powerful tax benefits that directly impact your bottom line:

1. Immediate Tax Savings

Traditional (pre-tax) contributions reduce your taxable income dollar-for-dollar.

For example: If you contribute $20,000 to your Solo 401k and you're in the 24% federal tax bracket, you'll save $4,800 in federal taxes this year. That's money that stays in your pocket instead of going to the IRS.

2. Tax-Deferred Growth

Your investments grow without the drag of annual taxation. No capital gains taxes. No dividend taxes. This tax-free compounding creates a significant advantage over taxable accounts.

For example: $100,000 growing at 8% for 25 years would be worth about $684,000 in a tax-deferred account, compared to just $488,000 in a taxable account (assuming 24% tax bracket). That's an extra $196,000 in retirement funds!

3. Roth Option Flexibility

Many Solo 401k providers offer a Roth option, allowing you to make after-tax contributions that grow completely tax-free.

This is ideal if:

- You expect to be in a higher tax bracket in retirement

- You want tax diversification in retirement

- You believe tax rates will rise in the future

Setting Up Your Solo 401k: Simpler Than You Think

Establishing your Solo 401k requires a few specific steps, but the process is straightforward:

Step 1: Choose a Provider

Select a Solo 401k provider that aligns with your needs. Consider:

- Setup fees and ongoing costs

- Investment options

- Roth contribution availability

- Loan provisions

- Customer service quality

Step 2: Complete Plan Documents

Your provider will help you complete:

- Adoption agreement

- Basic plan document

- Account application

Step 3: Obtain an EIN

If you don't already have an Employer Identification Number, you'll need to get one from the IRS (even if you're a sole proprietor). This takes just minutes through the IRS website.

Step 4: Open Your Account

Once your plan is established, you'll open your Solo 401k account and select your investments.

Step 5: Start Contributing

Make your first contribution! Remember these key deadlines:

- Plan establishment deadline: December 31st of the tax year

- Employee contribution deadline: December 31st of the tax year

- Employer contribution deadline: Tax filing deadline (including extensions)

Next Steps: Taking Action

If you're ready to supercharge your retirement savings with a Solo 401k, here's how to proceed:

- Calculate your potential contribution using our free calculator tool to see exactly how much you can save.

- Compare providers to find the one that best meets your needs and budget. See our provider comparison →

- Open your account before December 31st to qualify for this year's tax benefits.

Remember: Every year you delay costs you in missed tax advantages and compound growth. The best time to set up your Solo 401k was last year. The second best time is now.

Want to Maximize Your Solo 401k Even Further?

Once you've mastered the basics, explore these advanced strategies: